Pink Argyle Diamonds

Intro

When investing in diamonds you need an advisor who has the depth and breadth of knowledge in investment grade diamonds. Rare Diamond Investor provides seamless access for both novice and savvy investors. We focus exclusively on natural fancy-colored diamonds and are staffed by experts in every facet of the diamond market. This level of experience and expertise not only gives us greater understanding of the diamond market, but also gives us access to a professional global network of investors, collectors and industry specialists including the most sought after gemologists and diamond cutters in the world.

In today’s global economic landscape, we are living in uncertain financial and political times unlike any the world has experienced before. The Covid 19 pandemic has further compounded the uncertainty. The flight to alternative and tangible hard assets that provide reliable returns and safety from market turmoil continues to grow worldwide. Natural fancy-colored diamonds have steadily appreciated in value year after year and have provided protection and safety. Over the last decade, Argyle pink diamonds have consistently broken records on the global auction market, demonstrating the robust nature of the diamond market and the unceasing international demand. Christies auctions have surpassed records the last few years for both the most expensive investment grade diamonds and the highest price per carat.

Colored diamonds as an investment offer incredible potential for substantial long term returns due to a growing demand around the world. Meanwhile, supply is dwindling; with no major diamond discovery since 1997. This supply demand imbalance has provided colored diamonds with an excellent opportunity for long term outsized returns.

Investing in Colored Diamonds

Rare colored diamonds are fast growing as a preferred asset class of investors around the world.

The primary investment appeal of rare colored diamonds stems from their long-term history of strong, stable gains.

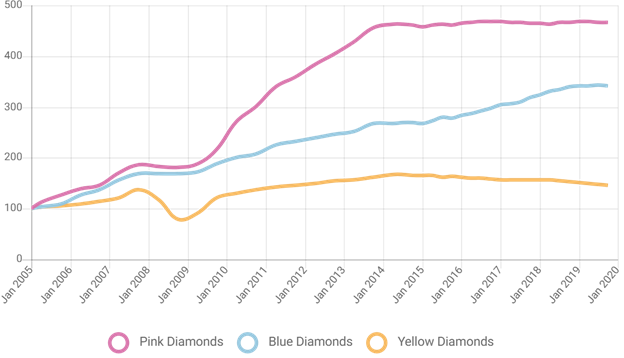

This is particularly true for the three most traded categories of coloured diamonds recognised for their investment appeal: yellow diamonds, blue diamonds, and most notably pink diamonds. Since 2001, natural blue diamonds have doubled in price every 5 years, pink diamonds have doubled in price every 6-7 years, and fancy yellow diamonds have doubled in value every 8 to 10 years.

To delve into what this performance looks like over time, below we see a composite representation of changes in price points gathered since 2005, based on a statistically significant sample size (tens of thousands of diamonds).

The index offers insight into variations in the appreciation of diamonds of different colours and sizes.

Historic growth of Pink, Blue and Yellow Diamonds to 2020

Source: Courtesy of The Fancy Color Research Foundation. All Rights Reserve

Pink Diamonds Stand Out

Rio Tinto’s Argyle mine produces 90% of the world’s pink diamonds, and holds the monopoly in Champagne, Red and Violet Diamonds. Supply of pink diamonds are limited to a few handfuls of new polished stones per year. To put in perspective, for every million carats of rough diamonds produced at the Argyle diamond mine, a mere one carat is suitable for sale. At a time when other investments are exposed to unparalleled uncertainty, natural fancy-colored diamonds have steadily appreciated in value. Over the last decade, Argyle pink diamonds have consistently broken records on the global auction market, demonstrating the robust nature of the diamond market and the unceasing international demand.Closure Announced

The announcement from Rio Tinto that the Argyle mine ceased operations for diamond mining in 2020 caused a stir amongst investors worldwide. There have been no recent discoveries of viable mining opportunities to replace this unique mine. If a new mine was discovered in the near future, it would still take approximately 15 years to reach the actual stage of producing diamonds to sell to consumers. This drastic supply shortage combined with increasing demand has positioned pink diamonds as one of the best opportunities for investors to realize significant capital gains in the mid-term.

BUSINESS CRISES AND PINK DIAMOND PRICES

Oil prices, the Coronavirus, and stock market fluctuations have the global financial market in a current state of turmoil. While this is indeed concerning, things always get worse before they get better, as they say. We need to remain calm and positive until all this rolls over.But what you currently might be thinking as investors is "how can I secure my wealth?"

In times of economic uncertainty, investors turn to tangible assets like art and gold to protect their wealth. Among these assets, loose diamonds see big spikes in popularity; and colored diamonds traditionally have risen to the forefront as one of the most stable and lucrative investments you can make during these times.

Pink Diamonds: A Stable and Growing Alternative Investment

Drawing correlations from the last financial crisis, as economic woes deepen investment focus shifts to hard assets. The last significant time of financial turmoil was experienced during the 2008 financial crisis and subsequent recession. As we can see from the graph below, colored diamonds, and in particular pink diamonds, saw a significant increase as investors turned to treasure assets to diversify and strengthen their portfolios.

But why colored diamonds? Simply put, they are extremely rare and can provide significant wealth security.

Only one diamond in every ten thousand is naturally colored, making it essentially impossible to flood the market or crash prices by other means. As any investor knows, a stable, long-term trend is always a good indicator of a solid investment opportunity with real potential to pay off. Having said that however, not every diamond color is made equal. There are varying degrees of rarity among the various color categories, with pink diamonds being among the rarest. Another crucial factor contributing to their immense increase in demand and price.

Why Invest in Pink Diamonds?

Pink diamonds have seen a spike in interest during recent years. This is mainly because they are getting rarer by the minute as the iconic Argyle mine, the producer of the Argyle Pink diamonds, ceased operations at the end of 2020.

The Argyle Mine in Australia is the premier supplier of naturally colored pink diamonds. The mine is not only responsible for producing over 90% of the world’s pink diamonds, it is also famous for bringing us some of the most beautiful colored stones with a hue unrivaled by any other. The Argyle Mine has exhausted its resources and as such, prices for this highly coveted asset will undoubtably soar over the coming years.

Pink Diamonds as a Secure and Portable Investment

In addition to value security, pink diamonds have seen an increase in a surge in popularity as a tangible investment due to their ability to be easily stored and moved. Contrary to larger tangible assets like paintings, classic cars, antique furniture, and real-estate, colored diamonds are highly portable and durable, and can be either stored right after purchase, or be later set in jewelry (if bought loose,) allowing you to enjoy and wear your investment.Loose Pink Diamonds or Jewelry?

When deciding between investing in loose or set diamonds, the latter is always the more enticing option from a visual aspect, but is it the best? Experts recommend the opposite, purchasing loose pink diamonds is better in the long run. But why specifically go for loose?As investors you must be wary when purchasing pre-set stones. Oftentimes these diamonds might be set in ways that hide various imperfections, and might not have optimal cut, clarity, and saturation that would yield the highest price at an auction. Furthermore, if you are thinking of liquidating your asset, loose diamonds are much easier to sell than those already set in a piece of jewelry.

The Verdict

Pink diamonds are a unique investment opportunity, especially during times of economic uncertainty. Their rarity makes them a stable selection, and the closure of the Argyle Mine will only continue to impact their value moving forward. They are certainly an option worth strongly considering for those investors looking for a stable treasure investment to offset market instability.